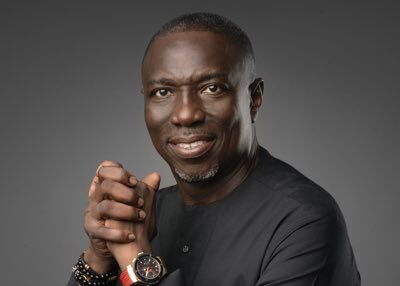

The chairman of the presidential committee on fiscal policy, Taiwo Oyedele, has highlighted reforms needed in Nigeria’s Value Added Tax (VAT) system.

Oyedele was quoted in a report to have said at an event on Monday that there is a need to increase Nigeria’s VAT rate which currently stands at 7.5 percent.

However, Oyedele in a statement on Wednesday said he was quoted out of context to suit the objective of the author and highlighted the issues with Nigeria’s VAT system.

READ ALSO: Oyedele denies proposing increment in VAT

The issues, according to Oyedele, include Nigeria’s VAT system placing a huge burden on businesses as they are not allowed to claim the input VAT incurred on services and assets.

He said some items which constitute basic consumptions (food, education, and healthcare) are liable to VAT rather than being exempt or zero-rated.

Oyedele said another issue is that any small businesses have to contend with VAT compliance in view of the existing low VAT exemption threshold for small businesses.

READ ALSO: Presidential committee considers increasing VAT rate

“Many states charge other forms of consumption taxes in addition to VAT thereby creating multiplicity of taxes,” he said.

“Export of services and intellectual property bear VAT rather than being zero-rated to promote exports.”

To address the above identified problems, Oyedele said that the presidential committee on fiscal policy is proposing some reforms including full input VAT credit for businesses.

Other reforms being proposed are removing VAT on essential items, harmonizing consumption taxes and increasing VAT exemption for small businesses.

He said that these proposals aim to alleviate burdens and stimulate economic growth across the country.

“We are proposing: full input VAT credit for businesses to reduce their cost of doing business and minimise the strain on their cash flows,” he said.

“Remove VAT on an expanded list of basic food, educational and healthcare items to protect the poor.

“Harmonise all consumption taxes into one (VAT only) and adjust the revenue sharing formula in favour of states to address multiplicity of taxes.

“Remove VAT on export of service and intellectual property to promote non oil exports. Increase the threshold for VAT exemption for small businesses.”

He added that the presidential committee on fiscal policy is proposing the enhancement of the VAT refund process to reduce the strain on working capital of businesses.

Oyedele said they have also proposed the introduction of VAT fiscalisation and electronic invoicing to curb evasion which makes honest businesses uncompetitive.

READ ALSO: Experts warn against another VAT increase

He added that there is the consequential upward adjustment to the VAT rate on items not exempted to avoid a significant drop in revenue.

Oyedele said it is important to note that the above proposals do not represent the position of the government but the committee’s reform proposals which they are discussing with the private sector for their input.

“At the same event, we discussed other proposals to reduce companies income tax rate, increase exemption threshold for personal income tax etc but of course will not make the news,” he added.